Additionally, notice that when you have any Part I tax legal responsibility in any respect, you’ll want to complete Schedule A (we’ll get to Schedule A, which tracks your deposits and liability by period). Schedule A is required when you report any amount in Half I. You can join with a licensed CPA or EA who can file your business tax returns. Book a free session today and let us take the burden off your plate. If your business solely handles one type of excise tax, like tanning or freeway use, and your operations are pretty easy, you may be capable of handle it on your own. Many tax software programs assist Kind 720 now, making it simpler than ever.

For various method taxpayers, the report have to be filed by the due date of the Type 720 that features an adjustment to the separate account for the uncollected tax. See Various technique (IRS Nos. 22, 26, 27, and 28) , later. Collectors using the choice methodology for deposits must adjust their separate accounts for the credit score or refund. For extra data, see Alternative method (IRS Nos. 22, 26, 27, and 28) , later. You can use PDSs designated by the IRS to fulfill the “timely mailing as well timed filing/paying” rule for tax returns and payments.

- Whether you’re a seasoned enterprise owner or simply beginning, understanding the intricacies of Type 720 can save you from potential pitfalls and make sure you remain within the IRS’s good books.

- The gasoline should have been used through the interval of claim for kind of use 2, 4, 5, 7, or 12.

- The gadget should be affixed to the tractor and determined by the Administrator of the EPA, in session with the Secretary of Power and Secretary of Transportation, to minimize back idling whereas parked or stationary.

- Section 6011 requires you to offer the requested info.

- For calendar year 2025, the part 4261 excise tax on any amount paid for worldwide air transportation, if the transportation begins or ends within the Usa, is generally $22.90.

Add the tax on every sale during the quarter and enter the whole on the road What is a 720 tax return for IRS No. forty two. Determine the tax for each tire bought in each category, as shown within the following chart, and enter the entire for the quarter on the road for IRS No. 108, 109, or 113. Additionally, a surtax of $.141 per gallon applies on gas utilized in an aircraft which is a part of a fractional possession program.

Understanding Form 720: What Is It And Who Must File?

If you sell sure products or services, you would possibly need to file Form 720 ( download here) with the IRS each quarter. This guide shows you precisely tips on how to file your excise tax returns. Typically, semimonthly deposits of excise taxes are required. A semimonthly period is the primary 15 days of a month (the first semimonthly period) or the 16th by way of the final day of a month (the second semimonthly period). The report should contain the name and tackle of the taxpayer, the type of facility supplied or service rendered, the amount paid for the ability or service (the amount on which the tax is based), and the date paid. Efficient December 23, 2017, certain funds associated to the administration of private aircraft are exempt from the excise taxes imposed on taxable transportation by air.

Lastly, notice that state and local excise taxes are separate from the federal excise taxes on Form 720. Many states impose their very own excise taxes (on gas, tobacco, cannabis, and so forth.), which require state-level filings – but these don’t get reported on Type 720. So you would possibly file Type 720 for federal taxes and nonetheless have to file a state excise tax return for state taxes on a product. All The Time check state requirements for any excise-like taxes your corporation faces (for example, state gasoline taxes are reported to your state’s income division, not the IRS).

California Wildfire Irs Tax Reduction Introduced: What You Want To Know

Keep good gross sales data and fee confirmations. Missing signatures on paper forms imply computerized rejection. Small businesses might owe nothing in the occasion that they made proper deposits.

The necessity to file Form 720 extends to companies concerned in specific goods and services topic to federal excise tax. Ascertaining whether or not your business operations mandate filing Kind 720 is the first crucial step in guaranteeing compliance. Understanding the nuances of what constitutes ‘topic to excise’ and ‘topic to excise tax’ is paramount for businesses to determine their tax liabilities precisely. Type 720 is used for the IRS’s method of tracking and accumulating excise taxes from firms that cope with goods like gasoline, tobacco, air transportation, vaccines, and even companies like indoor tanning. If your small business https://www.quick-bookkeeping.net/ touches any of these areas, you’ll probably must file this form each quarter. For sort of use 14, see Model Certificates P in Pub.

Half Ii – Different Excise Taxes (no Deposit Required)

The tax is 3% of amounts paid for native phone service and teletypewriter trade service. A responsible individual could be an officer or employee of an organization, a associate or worker of a partnership, an employee of a sole proprietorship, an accountant, or a volunteer director/trustee. A responsible individual may embrace one who signs checks for the enterprise or otherwise has authority to trigger the spending of enterprise funds.

If you can’t pay the total quantity of tax owed, you possibly can apply for an installment settlement on-line. You can apply for an installment settlement on-line if the entire amount you owe in combined tax, penalties, and interest is $25,000 ($50,000 for individuals) or much less, and you have filed all required returns. To apply utilizing the On-line Cost Settlement Utility, go to IRS.gov/OPA. The internet tax legal responsibility for a semimonthly interval isn’t lowered by any amounts from Form 720-X.

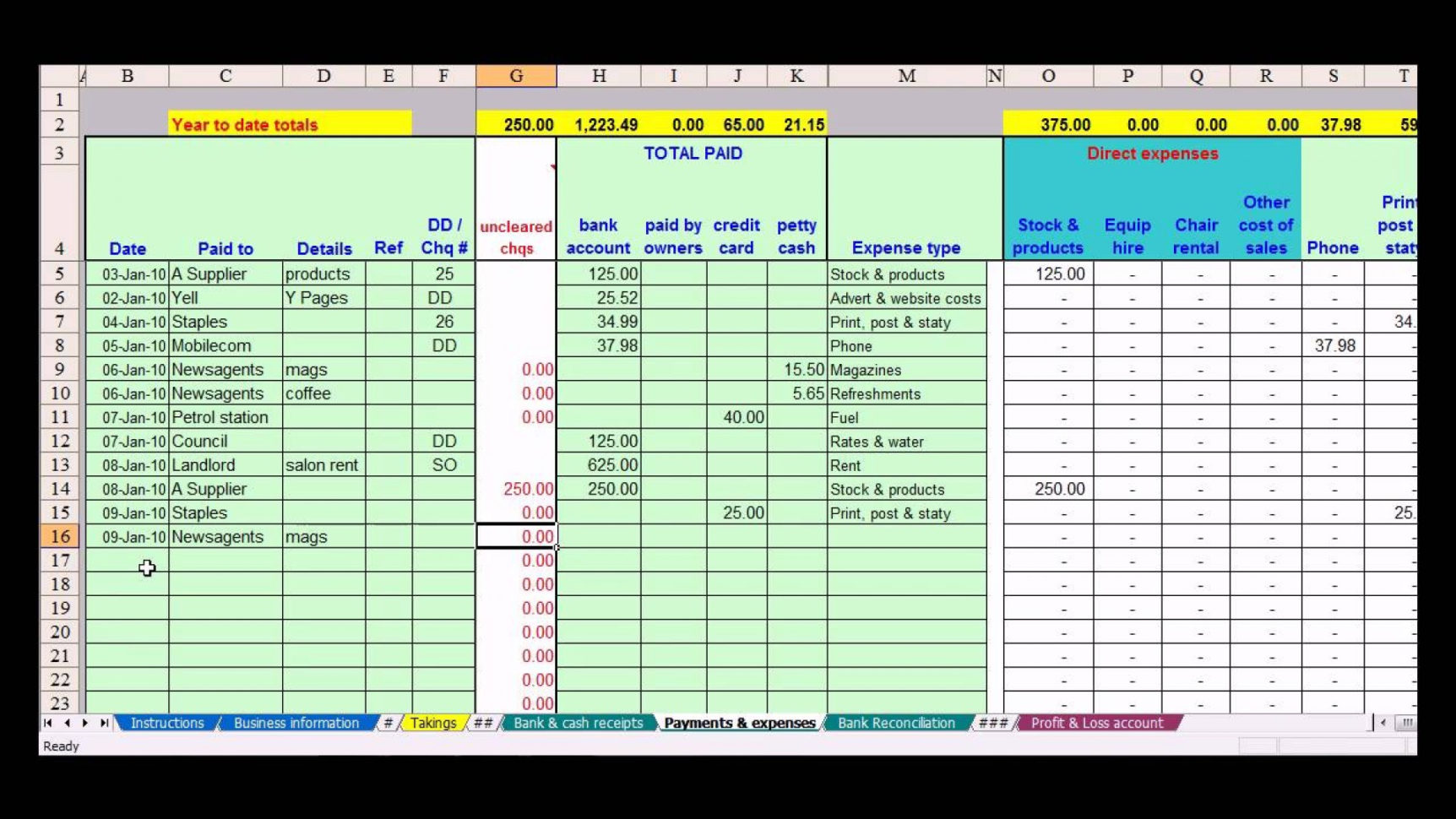

The Schedule A section of IRS Form 720 is for businesses that have a tax liability in Half I. If you don’t have legal responsibility from Half I but do have legal responsibility for Half II, you do not need to fill out Schedule A. Primarily Based on your whole sales/units offered and the respective rate, fill in your business’s tax responsibility in the “Tax” column. At the bottom of Half I, add up the entire taxes and fill in the complete. If after filing Type 720 you understand one thing was wrong – perhaps you underreported a tax (owed greater than you thought) or overreported (paid too much) – the IRS has a particular procedure to right it.

The tax doesn’t apply if the surtax on gas utilized in a fractional ownership program aircraft is imposed. See Surtax on any liquid used in a fractional possession program aircraft as gas (IRS No. 13), later. The percentage and home segment taxes don’t apply on a flight if the surtax on fuel used in a fractional ownership program plane is imposed.